Key Industry Trends

- Globally, large Industrial companies are increasingly focused on two key priorities: sales growth and cost management.

- The market has stagnated or slowed down in the matured economies of the world.

- This has pushed such players to look at new and emerging economies like India.

- This will contribute to the increase in hiring in the Industrial sector in India

- Investment into R&D will increase as Industrial organizations look to new technologies and services for growth.

- Industrial organizations need to reorganize their supply chains to support future global growth and reduce working capital.

- All the above factors would mean:

- Increased movement of work to countries like India and other emerging markets

- For India specifically, we expect more transition of high-quality work to the country compared to the past

- Focus may also shift to manufacturing locally with the global standards

- Increased focus on Supply Chain and Quality.

- More opportunities on global scale for the Indian Talent.

- Most critical/senior level hiring in Product companies and high tech development centers and start-ups will be of Product Managers, Senior Technologists and R&D professionals.

- The Industry will see continued shortage of good leadership talent.

- Industry leaders will have to foster key partnerships with Government and Universities to develop right skill sets from the grass roots.

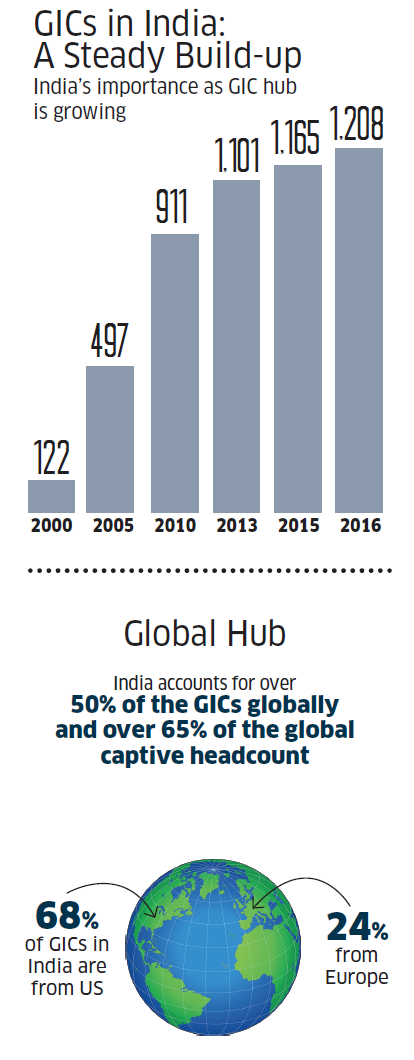

Overview of GICs in India:

- Originally called captive centers in the early 1990s, GICs are offshore centers that perform designated functions for large organizations.

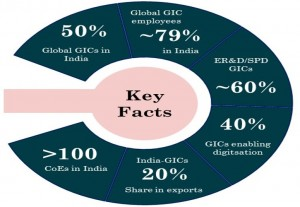

- GICs in India now number about 1,300, employing more than 950,000 employees. Bangalore constitutes about 45% of total GICs in India. GIC is broad term for any centre managing: Engineering R&D, Software Development, Technology Delivery, HR & Finance Services.

- GICs today have moved past the “cost center” stage and are focusing on IP-creation, building competencies around emerging technologies, setting up Centers of Excellence and vendor management.

- Today, an increasing amount of the work is in digital technologies such as Big Data and analytics, mobility, AI, machine learning, IoT, robotics, etc. This is driving MNCs to setup their centres in India to harness the talent.

Current Trends in GICs

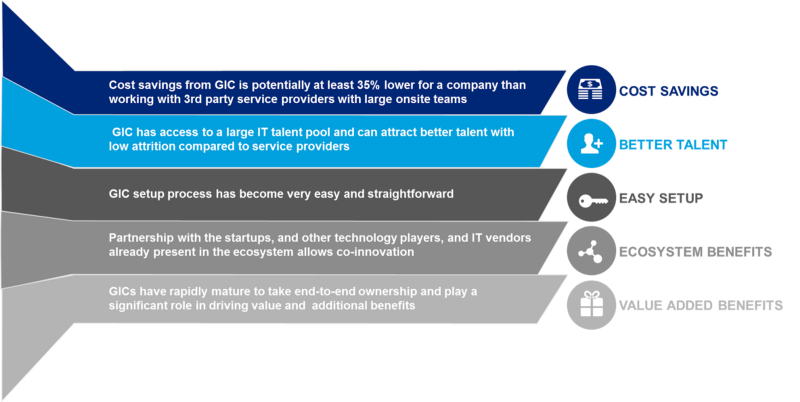

- More companies are opting for insourcing of the delivery compared to earlier outsourcing model.

- Captives provide a robust platform to build organizational capabilities in core, strategic and new areas such as digital technologies and advanced analytics.

- GICs allows for integration, superior collaboration, and better communication across entities

- Better control over IPs, Governance and uniformity in delivery

Bangalore as an R&D Hub

- 50%, or 225,000, of the MNC R&D workforce of 450,000 in India is in Bengaluru, as per a study by research firm Zinnov Consulting for 2018. Pune follows with 60,300, a quarter of that in Bengaluru; NCR is third with 41,000.

- The focus was more of product development for the global requirements in the earlier years. This has been changing with addition of new technologies in the areas of AI, Automation, Cloud, Mobile, etc.

- Bangalore also accounts for 456 of the 1,165 MNC R&D centers in India (there are 928 MNCs, with some having multiple centres in India).

- India (Majorly Bangalore) accounted for $14.3 billion, or 45%, of the total of $34 billion of globalized engineering and R&D in 2018.

- Large number of centers has been setup by IT, Semiconductor and Networking industries. Predominantly manufacturing companies have set up centers primarily catering to the verticals of Automotive, Aerospace & Defense etc.

Growth of companies’ R&D centers in Bangalore – Crestron Comparators

Other examples for Industrial captive technology centers of global MNC in Bangalore include Schneider Electric, ABB, Airbus, Philips, Samsung, Siemens, Shell etc.

Other examples for Industrial captive technology centers of global MNC in Bangalore include Schneider Electric, ABB, Airbus, Philips, Samsung, Siemens, Shell etc.

Beyond R&D: New Age & Technology – Digitization and Cloud Drive

The new age technology in cloud, digitization is relatively a recent development. These competencies are gaining momentum in the last 3-5 years. However, going by the current trend and future plans, such competencies are most sought out ones in the industry. Such competencies are industry agnostic and lot of cross industry movements are becoming very common.

The advent of technology startups and the global giants have led the growth in the new age technology development in India.

Organization like Crestron can strengthen their teams by targeting the talent from:

Startup Community: Talent currently associated with the organizations focused on AI, Digital etc. like,

- Flipkart

- Ola

- Paytm

- Oyo

- Big Basket etc.

Global internet organizations: which have large setups in India

- Amazon

- Walmart

- Sabre

- Adobe

- Expedia etc.

Global networking / Hardware development organizations: which have adopted new technologies:

- Cisco

- Broadcom

- Juniper Networks

- Samsung

- Xerox etc.

Note: The talent with the right competencies is aware of the demand. They have been taken well care in terms of compensation and they command a premium over other candidates. Apart from higher cash components, they are also provided with stock options which are really attractive.

Larger organizations setting up their operations need to be aware that good talent may not fit into their established structure in terms of Band, Experience and Compensation. We have seen organizations going out of their way to accommodate such talent.

Hiring Talent in India

Business sectors across domains have grown in this country over the last 20 to 25 years; largely due to opening up of the economy and the entry of MNC organizations. This has led to large employment creation across domains. India also has large English-speaking population that has made difference to MNCs setting up their businesses in India. From a talent acquisition professional’s point of view though there are certain peculiarities or nuances that might be helpful to understand.

Employability Quotient: Every year lakhs of students graduate from almost 3000+ engineering Colleges and 1000+ management schools. However, 70% of the hiring is done from the top 10 or top 15 engineering schools and top 10 B-Schools. This is due to the fact that a majority of the graduates score very low on social skills, interaction and communication and hence organizations find it difficult to scale up talent levels to match the demands of the global industry.

NASSCOM estimates that around 1.32 million engineering students to pass from their courses every year. Due to employability being low, this leaves only a handful of the skilled talent who can be considered for jobs in growing tech or development centers.

Offer Rejections: One of the peculiarities in India is offer rejections by candidates once offers are accepted, in writing. This is difficult for non-Indian professionals to understand, but is quite common in India, though over the years there have been consistent efforts to reduce this practice. This is primarily driven by a mix of supply and demand; and a low employability quotient and hence lesser number of suitable candidates. Suitable candidates understand the scarcity of their type and demand high which also contribute to the offer rejection problem.

Hence every talent acquisition professional needs to plan in advance for this problem. This is even truer for senior talent hiring as well and having at least two backups for every role is necessary.

High Increments expected year on year and job to job: The average growth in salaries this year is expected to be in double digits as per various studies. This has been the trend in R&D Industry as well where hikes generally come in double digits.

In India, candidates generally expect double digit (20 to 30% or higher) increments every time they change jobs and this is true of senior levels as well.

Value v/s Cost Arbitrage: While most global corporations started their centers in India, primarily because of cost arbitrage and availability of good tech talent. However, over the years this has changed to higher value creation from the better professionals. This has also contributed to the transitioning of core R&D work to Indian centers. Indian offshore centers of global MNCs have also started contributing higher end work. This has led to availability of better homegrown tech talent at senior levels.

Niche talent – high in demand – low in supply: Product organizations have always faced the crunch in finding strong product management and engineering talent in India. This has led to a demand supply issue where in the talent is at times imported from outside India at very high cost creating an imbalance is the compensation structure in India. However, the R&D activity in India has moved up the value chain considerably in the last few years. This has led to the creation of interesting job opportunities for the Indian talent to move back to India.

About WalkWater Talent Advisors

Holding a top rank in the list of leadership hiring companies in India, WalkWater Talent Advisors is a boutique talent advisory services firm, started by executive search industry leaders in May 2011. The firm combines best-in-class talent acquisition and talent advisory experience, deep sector expertise and a start-up drive to excel – all geared to providing an unparalleled experience to clients.