Healthcare Industry Insights

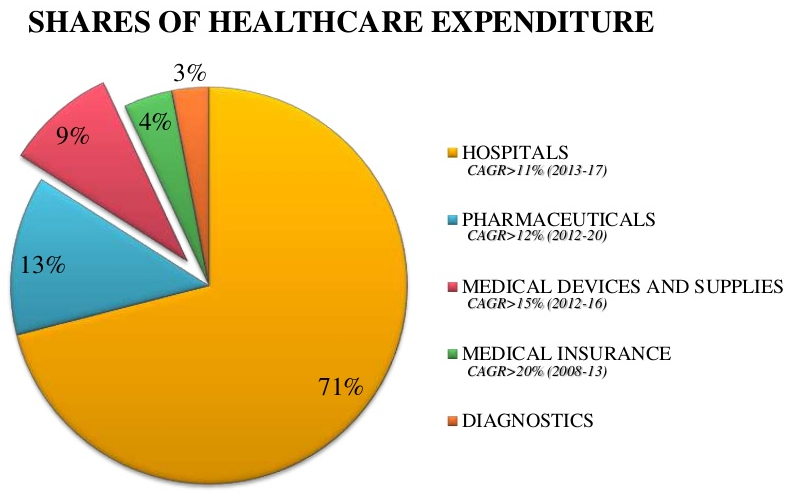

- Healthcare industry which comprises hospitals, medical devices, clinical trials, outsourcing, telemedicine, medical tourism, health insurance and has become one of India’s largest sectors in terms of revenue and employment.

- Healthcare in India is poised for growth and is expected to reach revenues of $ 372 Bn by 2022. This includes healthcare services, hospitals (both public and private), medical diagnostic services, medical equipment, Retail pharmacy, private health insurance etc. Indian Healthcare Industry contributes over 5% to the GDP.

- Rising incomes, greater health awareness, lifestyle diseases and increasing access to insurance will contribute to growth.

- Socio-economic changes such as rapid urbanization, demographic and lifestyle changes are more prone to lifestyle-related ailments, including diabetes, obesity, stroke and cancer.

Hospital Sector

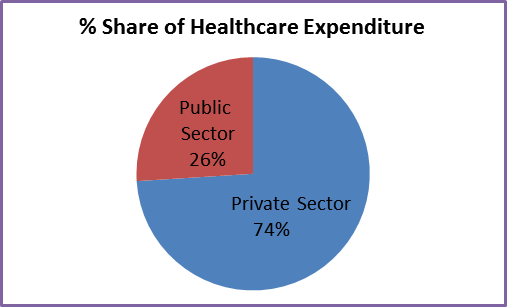

- Indian healthcare delivery system is categorized into two major components – public & private.

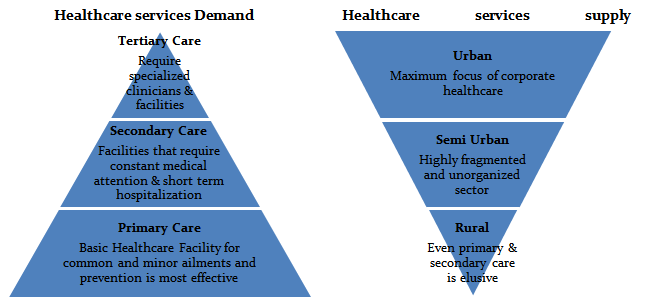

- The Public healthcare system (Government) – Limited secondary & tertiary care institutions in key cities and focuses on providing basic healthcare facilities in the form of primary healthcare centres (PHCs) in rural areas.

- The Private sector – Majority of secondary, tertiary and quaternary care institutions with a major concentration in metros, tier I and tier II cities.

- The hospitals business would continue to contribute to more than 70 percent of the healthcare sector.

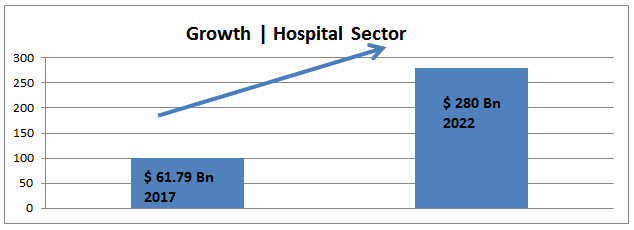

- The hospital industry turnover in India stood at $ 61.79 billion in FY17 and is expected to reach $ 280 billion by FY22 with a growth of 16 – 17% CAGR.

- In terms of Healthcare expenditure, more than 74% of healthcare expenditure today happens in the Private Sector. The private sector has emerged as a vibrant force in India’s healthcare industry, lending it both national and international repute.

Medical Tourism

- International tourist arrivals in India are expected to reach 30.5 Mn by 2028. By 2020 medical tourism is expected to touch $ 8 Bn. India treated 3.6 lakh foreign patients in 2016.

- The key selling points of Indian medical tourism industry are the combination of high quality facilities, competency, English-speaking medical professionals, cost effectiveness and the attractions of tourism.

- The cost differential is huge here:

- Open-heart surgery costs up to $70,000 in UK and $150,000 in the US; in India’s best hospitals it could cost between $3,000 and $10,000.

- The cost of Knee surgery is $8,000 in India; in Britain it costs $17,000.

- Dental, eye and cosmetic surgeries in western countries cost three to four times as much as in India.

Government Initiatives

- The Government of India has launched Ayushman Bharat in Sep 2018, the largest healthcare funded program in the world.

- This will cover over 10 crore poor and vulnerable families (approximately 50 crore beneficiaries) providing coverage upto 5 lakh rupees per family per year for secondary and tertiary care hospitalization.

- Ayushman Bharat – National Health Protection Mission will subsume the on-going centrally sponsored schemes – Rashtriya Swasthya Bima Yojana (RSBY) and the Senior Citizen Health Insurance Scheme (SCHIS)

- The government healthcare spends as a % of GDP is among the lowest in the world. The way of compensating for it has recently been to push pharma, medical device makers and hospitals to cut prices through policy interventions.

Healthcare | Demand & Supply

- Approximately 75% of the hospitals in India belong to the private sector, specifically to the secondary and tertiary segment

TOP PRIVATE PLAYERS IN INDIA

| Company | No of Beds | Presence |

| 10000 | Chennai, Madurai, Hyderabad, Bangalore and 30 other cities. Considered as pioneers in private healthcare. Perceived as providers of quality healthcare services at affordable rates. |

| 10000 | Mumbai, Bengaluru, Delhi, Kolkata and in 8 other cities in India. Also have hospitals in Singapore, Dubai, Mauritius and Sri Lanka. Has excellent brand image. Perceived to handle complex medical cases and are quick in response time. But has an image of being expensive. |

| 2500 | Delhi, NCR, Punjab and Uttarakhand. Has presence largely in North India. Looked at 2nd options after Fortis. |

| 5000 | Udupi, Bengaluru, Manipal and 8 other cities. It is perceived in setting up high standards in nursing, clinical excellence. Has high occupancy among large hospitals. Also seen as a group largely going for JV with other hospitals in tier 2 cities. |

| 7500 | Bengaluru, Kolkata, Ahmedabad and 17 other cities. A highly successful hospital in providing quality healthcare services at low-cost. Known for low cost heart Surgeries. A disruptive model but credible services. |

| 3500 | Coimbatore, Puducherry, Madurai and 8 other cities. Completely dedicated to Eye care and well known for its community services in south India. |

Recent M&As, Investments & investment Partners in the Healthcare sector

Major Healthcare investment partners

| Investors | Hospital Group |

| KKR | Max Healthcare, Baby Memorial Hospital, Kerala |

| TPG Capital | Manipal, Motherhood |

| Temasek Holdings | Dr Agarwal Eye Hospital |

| General Atlantic | Krishna Institute of Medical Sciences |

| Apax Partners | Apollo Hospitals |

| Everstone Capital | Global Hospitals, Sahyadri Hospitals, Maharashtra |

| The Carlyle Group | Medanta |

| IHH | Fortis, Global Hospitals |

| True North Advisors | Kerala Institute of Medical Sciences |

Recent investments & Acquisitions

- In Dec 2018, Radiant Life Care picked up a 49.7% stake for $293 million in Max Healthcare

- In Nov 2018, IHH Healthcare acquired 31.1% stake in Fortis Hospitals

- In June 2018, General Atlantic, invested $130 million to pick up a minority stake in (Krishna Institute of Medical Sciences) KIMS Hospitals.

- In 2017, True North invested $200 million in Kerala Institute of Medical Sciences

- In 2015, Malaysia’s Parkway Hospital owned by Malaysia’s biggest healthcare group IHH acquires 74% stake in Hyderabad-based Global Hospitals.

Talent Trends | Hospital Sector

Current challenges

- Year-on-year, the challenges facing the sector have remained the same.

- India needs an additional of 1.8 Mn beds to achieve the target of 2 beds per 1000 people by 2025. Global Average is 27 beds per 10000 people and India is 7.

- Availability of a skilled workforce – both doctors and nursing and support staff – is cringing. India has a shortage of Doctors, with 0.5 medics per 1000s against 1.5 globally.

- Despite this shortage, capacity expansions have happened only in metros.

- Compliance to regulations is still a cause for concern in both government as well as private run organizations.

Paucity

In the hospital industry there is a sheer dearth of people who have the requisite skills required by the hospitals. The shortage is most highly felt for doctors, nurses and, to some extent paramedical staff also.

High Attrition

There is sky high attrition in the industry, particularly of doctors and nurses. The attrition rate is about 40 percent for these two types of manpower, one of the highest in any industry in the country.

Relocation Issues

For hospitals chains that are well spread out in various cities, including tier 2 and tier 3 cities, the challenge to depute well-qualified staff, particularly doctors, in smaller cities is a major challenge.

Trends affecting the Recruiting Function

Candidate Driven Market

The current job market is 90% candidate driven. That means you don’t pick talent anymore. Talent picks you.

Building strong employer Brand

Recruitment marketing platforms offer great solutions for building a stronger employer brands. Having a reputation of a desirable employer to work for makes it much easier to attract qualified healthcare professionals when hiring in healthcare industry

Social Media Recruiting and Hiring in Healthcare industry.

Social media can be a particularly effective tool in healthcare recruiting because of the demanding nature of healthcare jobs. By utilizing social media in their recruitment strategies, healthcare organizations can meet job seekers on the platforms (such as Facebook, Twitter, LinkedIn etc.)

Healthcare recruiting and hiring using referrals

According to a survey 70% of healthcare companies use referrals for recruiting

Candidate Engagement and Experience in healthcare recruitment

Building strong relationships with both passive and active candidates before have an opening is necessary for hard-to-fill roles such as the ones in the healthcare industry.

About WalkWater Talent Advisors

WalkWater Talent Advisors is one of the top retained executive search firms in India & a boutique talent advisory services firm, started by executive search industry leaders in May 2011. The firm combines best-in-class talent acquisition and talent advisory experience, deep sector expertise and a start-up drive to excel – all geared to providing an unparalleled experience to clients.