Petrochemicals

Petrochemicals are chemicals made from petroleum or natural gas. They are mainly organic compounds derived from hydrocarbons. Some chemical compounds made from petroleum are also made from other fossil fuels, such as coal, or natural gas, or renewable sources such as corn or sugar cane. They are the building blocks that are essential to making the goods that make modern life possible — from paints to plastics, space suits to solar panels, medicines to mobile phones.

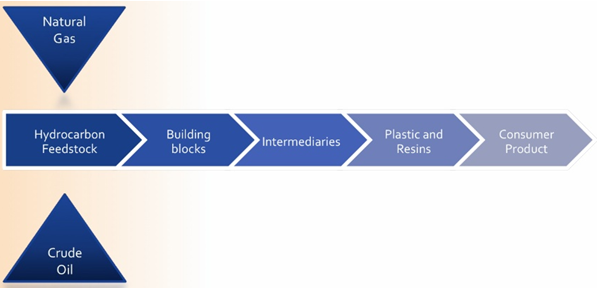

Petrochemical Industry Value Chain

Petrochemical Feedstocks

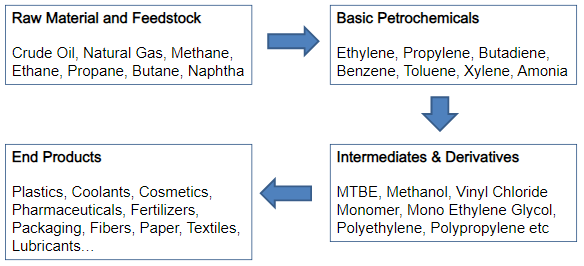

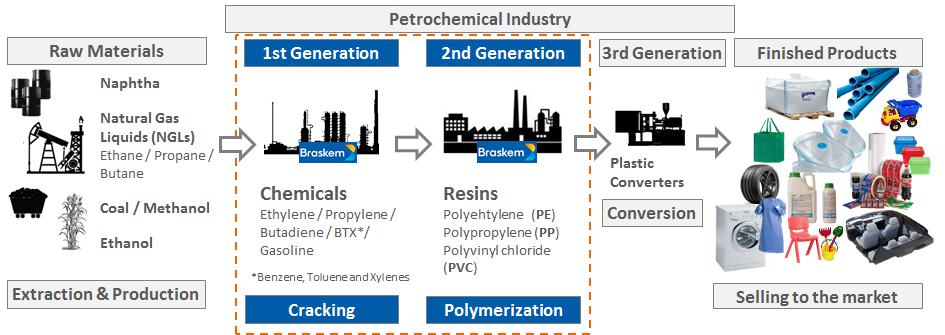

Components of petroleum used as raw materials in the production of petrochemicals are known as feedstocks. The raw materials are acquired from the energy industries, such as naphtha (derived from crude oil), natural gas liquids (extracted from natural gas) and coal.

- The feedstock goes through a steam cracker, where numerous basic petrochemicals are produced

- These chemicals are either sold to other petrochemical companies or, to create more value, go through a process of polymerization in which they become thermoplastic resins

- Resins are sold to converters, that transform them into finished products ready to be sold to the markets

Basic Petrochemicals can be classified into three general groups

- Olefins,

- Aromatics

- Synthesis gas and inorganics.

Olefins: These include ethylene, propylene, and butadiene. Ethylene and propylene are important sources of industrial chemicals and plastics products. Butadiene is used in making synthetic rubber. Olefins are produced by cracking.

Aromatic petrochemicals include benzene, toluene, and xylenes. Benzene is used in the manufacture of dyes and synthetic detergents. Toluene is used in making explosives. Manufacturers use xylene in making plastics and synthetic fibers. Aromatics are produced by reforming.

Synthesis gas (SynGas) is a mixture of carbon monoxide and hydrogen and is used to make the petrochemicals like ammonia and methanol. Ammonia is used in making fertilizers and explosives, where methanol serves as a source for other chemicals

Petrochemical Manufacturing Process

Technologies deployed to produce petroleum derivatives are

Steam Cracking: Steam cracking is a petrochemical process in which saturated hydrocarbons are broken down into smaller, often unsaturated, hydrocarbons. Saturated hydrocarbons are thermally decomposed into lower molecular weight hydrocarbons in a process known as steam cracking.

Input : Processing feedstock including ethane, LPG and naphtha

Output : Produces olefins and aromatics

Fluid Catalytic Cracking : Fluid catalytic cracking (FCC) is one of the most important conversion processes used in petroleum refineries. It is widely used to convert the high-boiling, high-molecular weight hydrocarbon fractions of petroleum crude oils into more valuable gasoline, olefinic gases, and other products.

Input : Product of gasoline

Output : Produces propylene

Catalytic Reforming: Catalytic reforming is a chemical process used to convert petroleum refinery naphtha distilled from crude oil (typically having low octane ratings) into high-octane liquid products called reformates, which are premium blending stocks for high-octane gasoline.

Input : By-product of gasoline

Output : Produces aromatics

Polymerization: Polymerization in the petroleum industry is the process of converting light olefin gases including ethylene, propylene, and butylene into hydrocarbons of higher molecular weight and higher-octane number that can be used as gasoline blending stocks

Technology Licensor Companies

Honeywell UOP : Formerly known as UOP LLC or Universal Oil Products, is a multi-national company developing and delivering technology to the petroleum refining, gas processing, petrochemical production, and major manufacturing industries.

W.R Grace: A US MNC conglomerate and global leader in Specialty Chemicals and Materials, Grace develops, manufactures, licenses, and supports industry-leading technologies through our Catalysts Technologies and Materials Technologies business segments.

It produces and sells catalysts and related products used in refining, petrochemical and other chemical manufacturing applications. The Grace Catalysts Technologies business segment includes three main product lines

- Refining technologies

- Advanced refining technologies

- Specialty catalysts

Axens: A US MNC and worldwide group that provides a complete range of solutions for the conversion of oil and biomass to cleaner fuels, for the production and purification of major petrochemical intermediates as well as for gas treatment and conversion options. The offer includes technologies, equipment, furnaces, modular units, catalysts, adsorbents and related services. Axens is ideally positioned to cover the entire value chain, from feasibility study to unit start-up and follow-up throughout the entire unit cycle life.

KBR: It provides purposeful and comprehensive solutions with an emphasis on efficiency and safety. With a full portfolio of services, proprietary technologies and expertise, it approximately 38,000 employees with ready to handle projects and missions throughout their entire lifecycle, from planning and design to sustainability and maintenance. Its comprehensive solutions cover a wide range of industries over the world. From large scale energy and chemicals sites and facilities, to mission critical services for aerospace and defence, to meeting the physical and digital infrastructure needs of governments and organizations across the globe, all our diverse projects and programs have one thing in common: its delivery

Haldor Topsoe : Haldor Topsøe is a Danish MNC in catalysis with approximately 2,300 employees, of which 1,700 work in Denmark. It specialises in the production of heterogeneous catalysts and the design of process plants based on catalytic processes. Focus areas include the fertiliser industry, chemical and petrochemical industries, and the energy sector (refineries and power plants). Haldor Topsøe A/S is one of the world’s leading companies within the field of heterogeneous catalysis, and over 50 per cent of the ammonia used for fertilizer on a worldwide scale is made with the help of technology from Haldor Topsøe

Chevron Lummus Global: Chevron Lummus Global (CLG), a joint venture between Chevron and McDermott, offers complete engineering services from conceptual studies to full engineering design packages. CLG has a line of hydro processing technologies covering a full boiling range spectrum and catalyst systems proven to exceed processing objectives for:

- Hydro processing Plants

- Distillate Hydrotreating

- Gas Oil Hydrotreating

- Hydrocracking

- Lube Dewaxing

- Lube Hydro finishing

- Residuum Upgrading

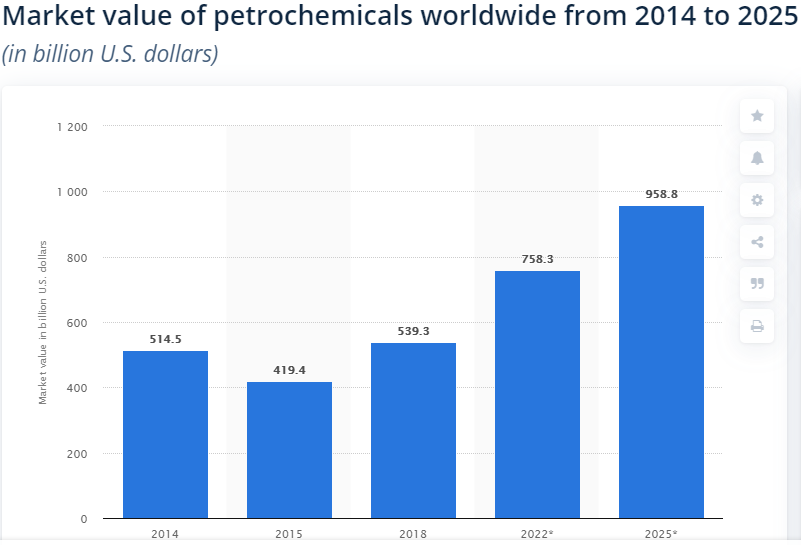

Global Petrochemical Industry

In 2018, the global market value of petrochemicals was 539 billion U.S. dollars, and is forecast to increase to 958.8 billion U.S. dollars by 2025. It is expanding at a CAGR of 8.5%.

Source: Statista

Source: Statista

Source – Deloitte Report

Source – Deloitte Report

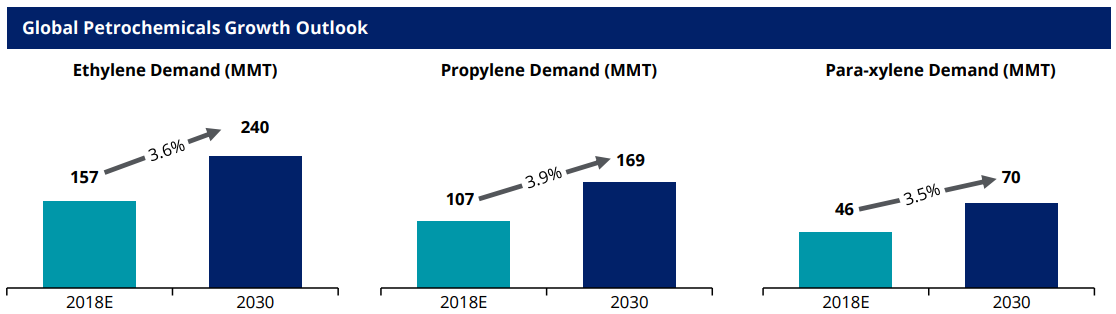

- Key petrochemicals, such as ethylene and propylene are likely to witness a 3-4% CAGR over the next decade with bulk of the demand arising out of the Asian markets.

- Asia Pacific is the dominating market for petrochemicals and accounted for over 50% of market shares in terms of volume. China is the leading contributor in the growth of APAC market by accounting 25% regional shares in terms of volume

Petrochemical Industry in India

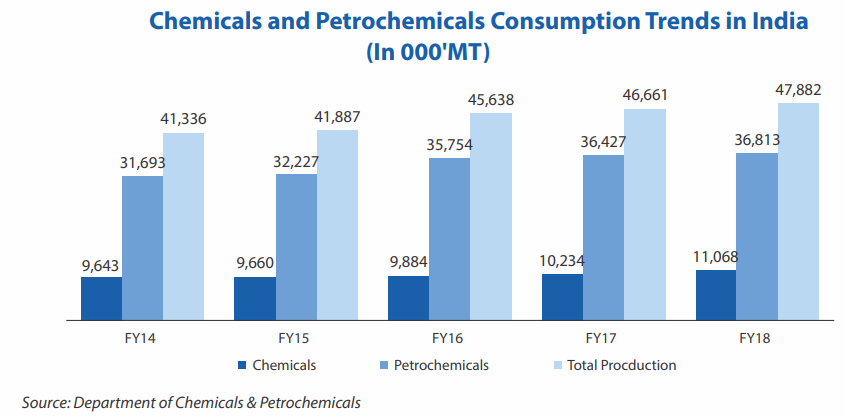

India’s Petrochemicals industry is close to 50 Billion USD and is expected to grow at a CAGR of 10% over the next 5 years to reach $ 100 bn by 2025. The industry contributes about 30 % to India’s chemical industry – ASSOCHAM.

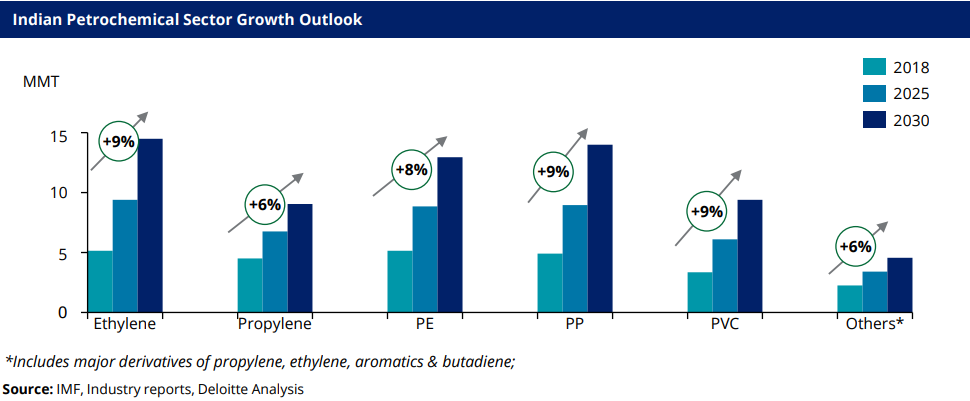

Basic Petrochemical Products Growth over the next decade (2018 to 2023 )

| Petrochemical Product | Percentage Growth |

| Ethylene | 9% |

| Propylene | 6% |

| PolyEthylene | 8% |

| PolyPropylene | 9% |

| PVC | 9% |

| Others (Includes major derivatives of Polypropylene, Ethyelene, Aromatics, Butadiene) | 6% |

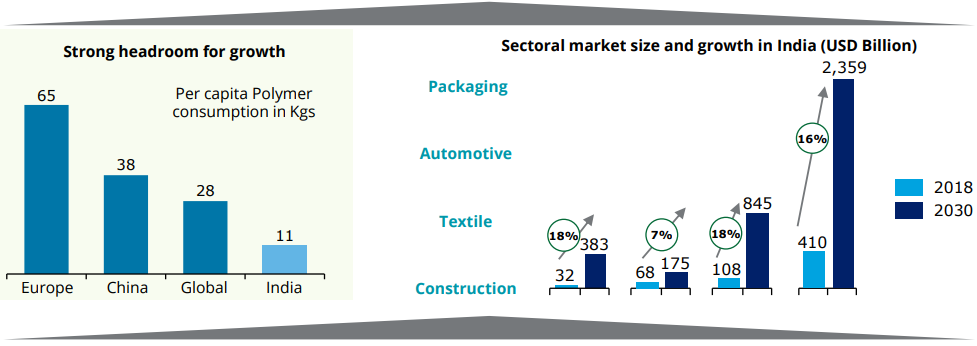

Petrochemical Industry – Sectoral Market Size by Consumption and Growth Potential

- India’s per capita plastic consumption is lowest in the world which provides huge headroom for growth

- Key sectors driving petrochemical consumption are expected to grow at ~10% CAGR during 2018 to 2030

Petrochemical Industry – Few Players and their Production Capacity

| Organisation | Locations | Capacity |

| Reliance Petrochemicals | Allahabad, Barabanki, Dahej, Jamnagar, Hazira, Hoshiarpur, Nagothane, Nagpur, Patalganga, Silvassa and Vadodra | Aromatics: Paraxylene capacity is 4.3 MMTPA and Benzene capacity is 1.4 MMTPA. Polysters: 2.5 million tonnes per annum Fiber intermediates: Purified Terephthalic Acid (PTA) 5 MMTA |

| NOCIL | Navi Mumbai and Dahej | |

| Haldia Petrochemicals | Haldia | Ethylene: 7, 00,000 TPA Total capacity for polymers: 3,50,000 TPA |

| IOCL | Digboi (Upper Assam), Guwahati (Assam), Barauni, Gujarat, Haldia, Mathura, Panipat, Paradip | Paraxylene: 3,60,000 MTPA. Purified Terephthalic Acid from Paraxylene: 5,53,000 MTPA of Naphtha Cracker Plant: Polypropylene: 600,000 tonnes High Density Polyethylene (HDPE): 300,000 tonnes Linear Low-Density Polyethylene (LLDPE): 350,000 tonnes Mono Ethylene Glycol (MEG) plant: 325,000 tonnes |

| IG Petrochemicals | MIDC Taloja (4 plants) | Phthalic Anhydride: 222110 MTPA Maleic Anhydride: 8000 MTPA Benzoic Acid: 1300 MTPA Plasticizers: 8400 MTPA |

| GAIL | Pata (UP) | |

| Manali Petrochemicals Limited | Chennai | Propylene Oxide: 27000 metric tonnes Propylene Glycol: 14,000 metric tonnes Polyether polyol and System polyol: 15,000 metric tonnes |

| Brahmaputra Cracker and Polymer Limited | Lepetkata (Odissa) | HDPE and LLDPE totalling upto 220000 TPA. PP: 60000 TPA |

| Mangalore Refinery and Petrochemicals Limited | Katipalla | Polypropylene: 4,40,000 MT/annum. |

| HPCL Mittal Energy Limited | Punjab | Produces range of Homo PP: 467000 KT (kilotonne) |

| Hindustan Petroleum Corporation Limited | Mumbai, Visakhapatnam, Bathinda, Barmer (Rajasthan) | |

| Chennai Petroleum Corporation | Nagapattnam and Chennai | Chennai refinery: 10.5 MMTPA Nagapatnam: 9 MMTPA |

Chemical and Petrochemicals Sector: Advantage India

- Indian Chemical and Petrochemical Sector – among the fastest growing in the world: Indian chemical industry is one of the fastest growing in the world. Currently it ranks 3rd In Asia and is 6th largest market in the world with respect to output after USA, China, Germany, Japan and Korea.

- Consumption Driven Demand: Indian chemical industry’s growth is largely driven by country’s consumption growth story. Per capita consumption of chemicals India is 1/10th of world average, and even among developing countries Indian consumption is low. This makes India a very attractive destination to invest and grow.

- Location Advantage – Future East West Connect: Indian peninsula is centrally located between the East and the West of Asia. It is also centre of the trans-Indian Ocean routes which connect the European countries in the west and the countries of East Asia.

- EODB & Regulations: Over the past few years, India has made considerable progress in its business environment, represented by Ease of Doing Business (EODB) matrix. India saw quantum leap in its relative position of EODB ranking from 130 to 100 in year 2017.

- Talent availability (Skilled Workforce): India is one of the leading countries generating skilled workforce. Chemical Industry in India employs more than 2 million people. Hence, an attractive preposition for global players.

- Improving Infrastructure: PCPIR’s (Petroleum, Chemicals and Petrochemicals Investment Regions) and Plastic parks will provide state-of-the-art infrastructure for Chemicals and Petrochemicals sector. In the next two decades almost $1.5 Tn investments have been planned for infrastructure. 4 PCPIR’s have been announced in the states of Andhra Pradesh (Vishakhapatnam), Gujarat (Dahej), Odisha (Paradeep) and Tamil Nadu (Cuddalore and Naghapattinam)

Challenges

- Limited Availability of Feedstocks

- Sluggish Growth in Maturing Economies

- Volatility in Crude Oil Prices

- Uninterrupted power supply

- New reserves discovery

- Pollution

- Increased competition from imports.

- India has poor physical infrastructure and even pace to construct these basic facilities for business is very limited

Major Government / Private investments in the Chemical / Petrochemical Sector

- HPCL to invest ₹74,000 crore in five years (21st Aug 2019)

- Saudi Aramco’s acquisition of 20% stake in Reliance Industries’ refining and petrochemicals business, valued at $75 billion. (13th Aug 2019)

- Adani partners with UAE’s Adnoc, Germany’s BASF for $4 billion chemical venture. (17th Oct 2019)

The total investment for establishment of the chemical complex in Gujarat’s Mundra is estimated to be up to $4 billion (about Rs 28,400 crore), the companies said in a statement, but did not state which firm will hold how much stake.

About WalkWater Talent Advisors

WalkWater Talent Advisors has emerged as one of India’s fastest growing and innovative leadership search and talent advisory firms. The WalkWater team brings a unique mix of strengths – Intensive Client Partnering, Deep Domain Knowledge and Global Coverage; this coupled with a start-up drive to excel, and a constant focus on values, provides an unparalleled experience to our clients.

Being one of the leading talent acquisition companies in India, the Industrial Practice of WalkWater has a proven capability of closing difficult searches globally with marquee Indian and MNC organizations across sub-sectors such as: Oil, Gas & Energy; Metals and Mining; Power and Energy Management; Infrastructure; Engineered and Capital Goods; Automotive; Process; Aerospace & Défense and Building Materials.

The practice has consultants who are engineers by qualification and bring solid industry and technical understanding having themselves worked in sectors such as Metals, Automobile, Farm Equipment and Aerospace. The combined experience with domain expertise in the Executive Search industry gives the team an edge in building leadership teams, advising board members and CXO leaders on talent, industry trends and do a thorough and in-depth functional, behavioral and culture fit assessment for the searches.